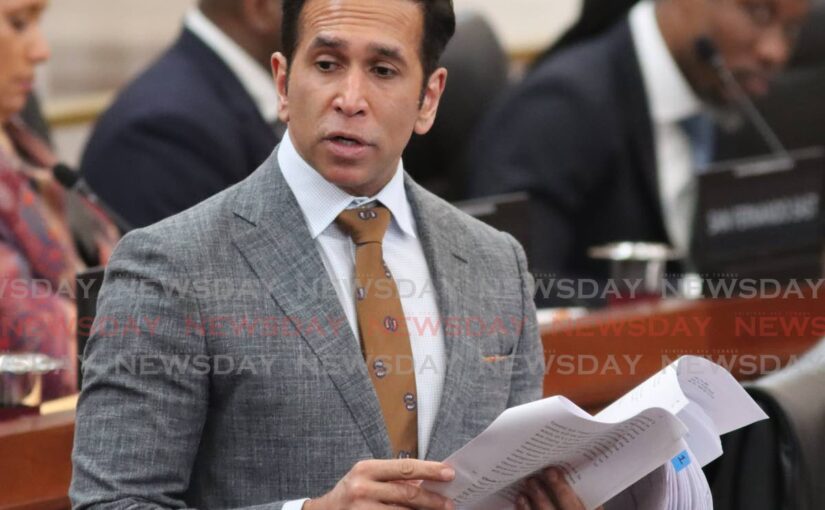

Al-Rawi upbeat on $$ for local government

Written by Clint Chan Tack on October 3, 2024

RURAL Development and Local Government Minister Faris Al-Rawi says he is very upbeat about the allocation his ministry received in the 2024/2025 budget and additional revenues of over $91 million, which can flow into the coffers of local government corporations from the collection of property tax.

He added he knows complaints and allegations will be thrown at him over the allocation of money to his ministry.

Al-Rawi promised to respond to all those matters when he contributes to the budget debate, which begins on October 4 in the House of Representatives at 10 am, with Opposition Leader Kamla Persad-Bissessar’s response to the budget.

Al-Rrawi made these comments to the media during a tour of the Southex Expo 2024 at Gulf City Shopping Mall in La Romaine on October 2.

His ministry received an allocation of $1.771 billion in the $59.7 billion budget.

Referring to Southex, a major annual business exposition in South Trinidad, and something he is very proud about as San Fernando West MP, Al-Rawi said this allocation was important to the ministry’s efforts to stimulate business at the local government level.

“This feeds local economic development.

“This footprint of Southex can go in other parts of San Fernando and other parts of the country.

“That is going to be funded by a lot of what we have in the developmental programme, PSIP (Public Sector Investment Programme) and the IDF (Infrastructure Development Fund) as well as the Rural Development Company (RDC).”

Al-Rawi said the allocation the ministry received this year was approximately the same as last year’s.

“We can work with what we have.”

He predicted there would be complaints and claims from people that the allocations they or certain entities which fall under the ministry received were insufficient, funds were taken away from them or they received no funding.

“I absolutely expect fire, brimstone, complaints and allegations.

“The fact is, we are in an election year with a fragmented opposition. There is now a ‘UNC A’ and a ‘UNC D.'”

Al-Rawi identified UNC MPs Rushton Paray, Anita Haynes-Alleyne, Dinesh Rambally, Dr Rai Ragbir and Rodney Charles as members of the latter. These MPs have all publicly challenged the UNC’s ability to win the next general election with Persad-Bissessar as its leader.

They were reassigned to the bottom of the opposition’s front bench in the House on September 9.

Al-Rawi said, “What is going to come out of that is nothing positive.”

He added that local government corporations need more money than they currently receive.

“The average request for funding from a corporation, in the large corporations, is about $100 million.”

But they currently receive between $20 and $27 million.

He added, “The supplementation of that funding has in part been addressed in the budget, because the Minister of Finance has informed that we have collected close to $91 million in property tax, and that is to be distributed across the 14 corporations and supplemented, because you will have some corporations that have lower takes than others, because they are less densely populated.”

Al-Rawi said property tax revenues will go into the corporations’ statutory funds.

“Once it is in the statutory fund, it can be used for a variety of purposes.”

What goes into the statutory fund, he continued, is not returned to the Consolidated Fund at the end of the financial year. Al-Rawi said under the Municipal Corporations Act, corporations keep unspent balances in their statutory funds.

“That is why all corporations have unspent balances. So, that will go into the unspent balance column. So it is not returned to central government.

“Ideally, the government will want to push that money into developmental projects to supplement drains, retaining walls, bridges, footpaths, maintenance and facilities.”

He repeated that a big feature of local government reform is local economic development.

Al-Rawi said no property taxes had been collected since 2009, under the former Patrick Manning administration, because the former UNC-led People’s Partnership coalition government was vehemently opposed to it.

“We went from $0 to $91 million.”

Al-Rawi hinted that because of the tax amnesty Imbert announced on September 30, there is a possibility of the total amount of property tax revenues exceeding the $91 million figure, which Imbert mentioned in his budget presentation, being distributed to local government corporations.

The tax amnesty runs from October 1- December 31 to allow people to pay outstanding taxes before the TT Revenue Authority becomes operational. The deadline to pay has been extended from September 30-November 29.

The Finance Ministry said consequently, owners and occupiers of residential land in receipt of a notice of assessment from the Board of Inland Revenue (BIR) have until November 29 to pay the tax without incurring any penalties.

Against this background, Al-Rawi said, “You can at least expect an incrementally better service (from local government corporations) because you can pay for it.”

He added that a conversation needs to happen so people understand the level of work that corporations need to do and how the revenues they receive will be spent to do that work.

“At the end of the day, we have to earn money to spend money.”

The post Al-Rawi upbeat on $$ for local government appeared first on Trinidad and Tobago Newsday.