The forex crunch: US$ supply shortfall affects travel to trade

Written by Ryan Hamilton-Davis on November 14, 2024

TT, like some other countries, is in a serious foreign exchange pinch, one that is affecting small and big business alike and making it hard for a country heavily dependent on imports to do business with their partners abroad.

It is not a new thing – the forex crunch the country is experiencing has been emerging since around 2015 – but now, it is an undeniable strain on the nation’s ability to do business and continue with its current way of life.

Recently, stiff restrictions and reductions in limits in access to US currency from the banks have made it all the more difficult, leading business people and individuals alike to turn to an unregulated market to access US cash, for imports, business and personal travel.

According to the first part of the Exchange Control Act, the import and export of any currency considered legal tender in TT is prohibited to anyone without the permission of the banks. People contravening this act could be subject, on summary conviction, to a fine and imprisonment of up to two years and on conviction on indictment, imprisonment up to five years.

Fines for people in contravention of this act could go from a summary conviction of $5,000 or, on conviction on indictment, $10,000.

However the act adds that where the offence involves currency, securities, gold goods and other property and the offender does not provide any information or produce books, a larger fine may be imposed, up to three times the maximum amount of the currency, security, payment, gold, goods or property.

The act also legislates how much money citizens may travel with at any given time and allows up to US$5,000 or the equivalent in another currency and up to TT$20,000.

Anything higher and you will have to declare it with the bank.

Banks as well have their own limitations. Last week, the Bankers’ Association of TT said in a media release that its members manage their forex allocations in compliance with policies laid down by the Central Bank (CBTT).

A discrete cash transaction through the unregulated market.

Photo courtesy Freepik –

It said its members get a fixed allocation from CBTT and are prohibited from purchasing foreign exchange above a specified rate.

They are also obligated to sell forex at a specified spread, taking into priority trade, people who need medical treatment abroad and living expenses for people studying abroad.

With regard to credit cards, which many people and businesses use to access US$, limits have been reduced over the past few years.

Last year, Republic Bank announced that from September 21, the US-dollar credit limit would be reduced from US$10,000 to US$5,000.

Scotiabank announced earlier this month that from December 1, the US-dollar spending limit for its Aero Mastercard Black would be reduced to $5,000 and all other credit cards to $2,000.

Even accessing cash from the bank is severely limited: while the limit a person can travel with is US$5,000, banks have been giving less than US$500.

President of the Confederation of Regional Business Chambers Vivek Charran said this is becoming a severe hindrance, especially for small businesses which depend on US currency for business travel.

“People think that forex is only used in business for trade and the purchase of goods and services, but one of the other most important things that forex is used for is travel.

“Travel outside of TT cannot happen unless you have US dollars. Your aeroplane tickets are going to be paid for in US. Your hotel stays are going to be paid for in US. US dollars is your currency by which you can change money. When you get to a foreign country to change their currency, they’re not going to accept TT or any other type of currency; it’s mostly in US dollars.

“So also not being able to access US dollars and curtail credit card limits are going to severely affect business travel.”

This, Charran said would be one reason why some businesses may turn to alternative means to access quick cash in foreign currency.

Businessman Stephen Lin said he tries to buy foreign currency from individuals and tourists who have US currency to garner enough US cash for his imports.

He said he sometimes tries to access forex through his family in China, but, because of limitations in that country, he sometimes does not get it.

“I ordered some goods for next year and I have some yuan in an account in China. The goods are coming from a company in China as well so I asked if I could pay for my order in yuan and I explained that there was a shortage in TT. They said yes, at first. They said they could take the yuan and convert it.

“Then they said they wanted it in US, explaining that there was an issue with the declaration form for exports.

“China has a US-dollar problem too,” he said. “I have family in China but one person can only access US$50,000 per year. My relative sent it already, and he can’t send another $50,000, otherwise the government will freeze their accounts.”

“I tried to go to China and talk to other family members, but they said they needed their currency for their own uses.”

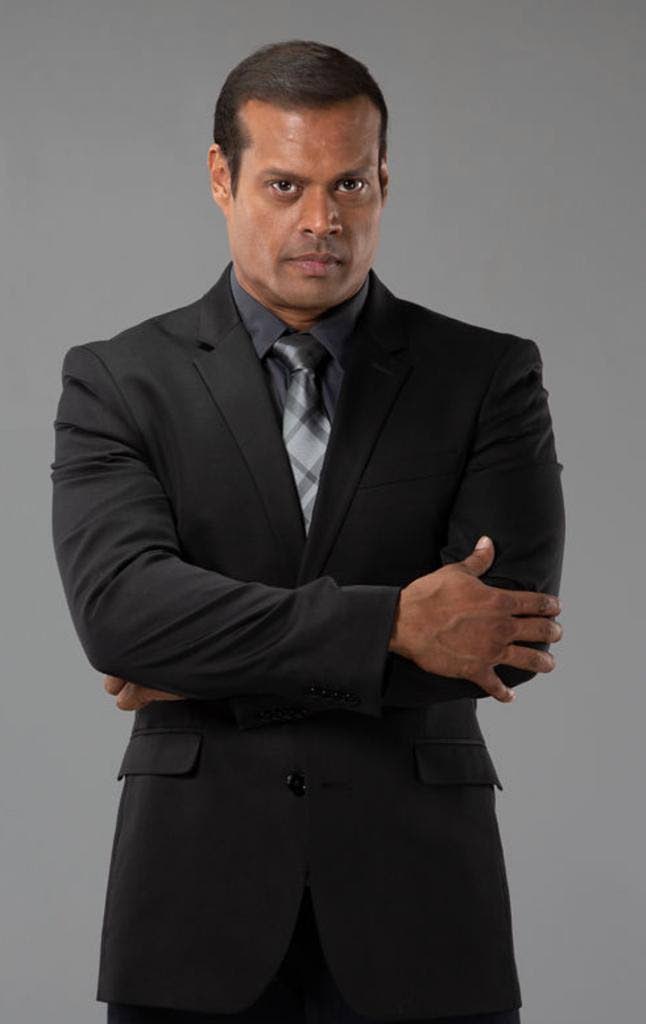

President of the Confederation of Regional Business Chambers Vivek Charran –

He added that getting forex from tourists and customers only leads to him getting a few hundred dollars on a good day. As his business is slow for the moment, he has less chance of earning foreign exchange.

Other businesses owners said they save the US currency for their own personal use and, on occasion for the purchase of goods.

Outside banks, people could, like Lin, trade through buying currency.

During a walkabout in Port of Spain on Monday, Business Day found out that businesses would usually buy US currency at between TT$7.20-TT$7.50 to US$1.

The official exchange rate is currently TT$6.80 to US$1.

Former finance minister Mariano Browne also noted that cambio systems, another foreign-exchange network which is authorised by the Central Bank to trade in currency, also provide higher exchange rates than the bank.

“If you have $100,000, will you go to the commercial banks and sell it for $6.80, especially knowing that there is a business there willing to buy it for you at $7.50 or $7.75?

“That is where we have to say people want to enforce a law which is not in accordance with commercial practice.”

Business Day attempted to reach two cambios – GraceKennedy Cambio service and the Cambio TT – but calls to one went unanswered and management at the other declined comment, promising to call back at a later date.

The post The forex crunch: US$ supply shortfall affects travel to trade appeared first on Trinidad and Tobago Newsday.