Republic Bank economist: Imbert presented ‘hold strain’ budget

Written by Narissa Fraser on October 1, 2024

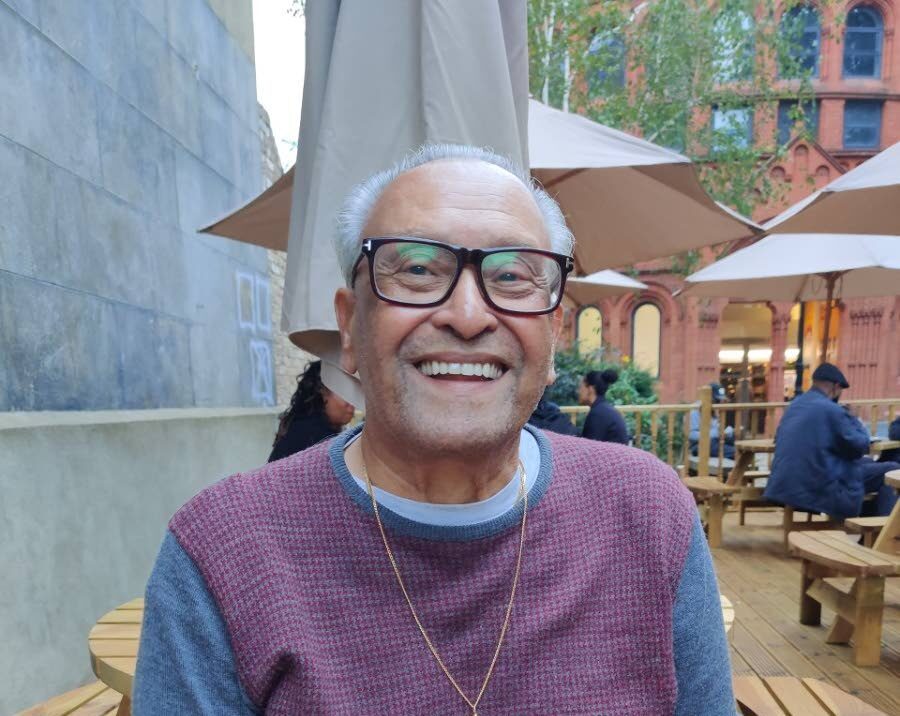

ECONOMIST at Republic Bank’s economic intelligence unit Garvin Joefield said although the 2024/2025 budget did not present many new initiatives or “pre-election goodies,” it was reasonable given the challenges faced by the country. He added that it was “portrayed as a mechanism to help the country hold strain until it can tap into the cross-border energy resources” from 2027.

Finance Minister Colm Imbert read the $59.7 billion budget in Parliament on September 30 for over five hours.

In a press release on October 1, Joefield said he believes the government used the budget presentation to list its accomplishments since the general election is to be held next year.

“(They were) sure to highlight that the country recorded a third consecutive year of economic growth in 2024, notwithstanding challenging domestic and global conditions.

“As encouraging as this is, the 1.9 per cent growth in real GDP recorded during the year, fell short of earlier projections by the IMF (2.4 per cent) and was not enough to take domestic economic activity back to pre-pandemic levels.”

He said leading up to the budget, the government’s efforts to manage expectations “stoked expectations/fears” that it would ease some of its fiscal burdens.

“…By further cutting expenditure on the fuel subsidy both at the gas station pump and regarding electricity rates. Instead, the finance minister announced the government’s plan to once again, use one-off revenue measures (the sale of assets) to help finance its expenditure – a strategy that featured prominently early in its previous term in office.”

He said it focused heavily on continuing existing initiatives.

“And so it did not offer a plethora of new initiatives. It also did not provide much in the way of pre-election goodies,” he said. “Given the pressure placed on the nation’s fiscal account, it would have been foolhardy for the administration to attempt to provide that type of budget.”

The budget was based on an oil price of US$77.80 per barrel and a natural gas price of US$3.59 per mmbtu.

Joefield said these prices are in line with forecasts made by the US Energy Information Administration.

“Capital revenue is expected to total $4 billion, up from $ 2.9 billion, with government highlighting its intention to divest its holdings of Clico shares, the Pointe-a-Pierre refinery and the Magdalena hotel in Tobago. At the same time, energy revenue is projected to fall by 3.9 per cent, while non-energy revenue is envisaged to rise by seven per cent.

“If these projections are actualised, government will incur a $5.5 billion fiscal deficit, estimated at 2.9 per cent of GDP, down from 3.5 per cent a year earlier.”

He said given the high murder toll, people were looking forward to hearing about national security.

“While these initiatives and acquisitions (presented) have the potential to bring relief over the medium-long-term, they likely fall short of the more immediate, strong responses some citizens were hoping for, such as a limited state of emergency.”

On the minimum wage increase for public sector workers from $20.50 an hour to $22.50 an hour, he said this could price some firms out of the market or force them to increase their compensation packages even beyond $22.50 to complete.

“For years, SMEs (small-medium enterprises) have complained about labour shortages, with some of them indicating that they are not able to compete with URP (Unemployment Relief Programme) and CEPEP (Community-Based Environmental Protection and Enhancement Programme) wages and hours, in particular.

“This (increase) will likely result in the very consequences the minister sought to avoid, namely increased strain on small and marginal firms and increased unemployment.”

But he said the decision to settle outstanding VAT refunds will be welcomed by affected companies and provide a “lifeline” for many SMEs.

Joefield concluded, “Overall, the 2024/2025 budget is reasonable given the challenges facing the country and the wider global economy. While it is not filled with an abundance of new initiatives, it does seek to bring relief to certain sections of society.

“However, the minister suggests a very heavy dependence on the benefits the country is expected to receive when it is finally able to access the energy resources that straddle the nation’s border with Venezuela. While this is understandable, ongoing events in that country and/or the potential change of administration in the November US presidential election could place the deals in jeopardy.”

The post Republic Bank economist: Imbert presented ‘hold strain’ budget appeared first on Trinidad and Tobago Newsday.